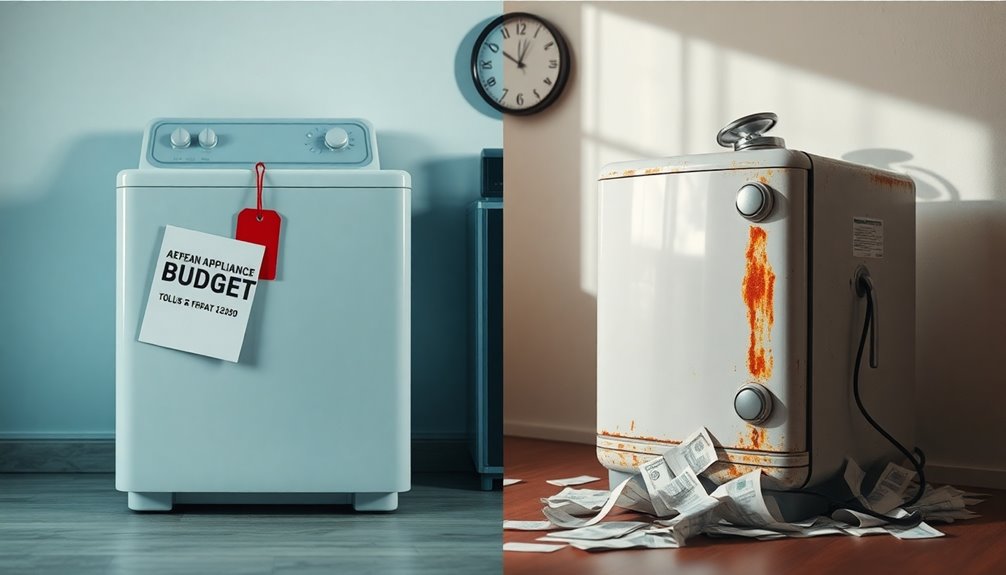

Budget options often seem tempting, but they can lead to hidden costs that add up over time. Cheap products tend to wear out quickly, forcing you to constantly replace them, which ultimately costs you more. Additionally, low-quality services may leave you underinsured, leading to unexpected expenses later. While spending less upfront seems wise, it can backfire when you consider the total cost of ownership. Investing in durable, high-quality items not only saves you money but also promotes sustainability. If you're curious about making smarter choices, you might find valuable insights just ahead.

Key Takeaways

- Cheap products often wear out quickly, leading to frequent replacements that accumulate higher costs over time.

- Low-quality items may increase monthly expenses due to their inefficiency and need for constant replacement.

- Budget options can result in inadequate services, exposing users to unforeseen high costs and operational inefficiencies.

- Investing in quality items promotes sustainability, reducing waste and enhancing long-term savings through durability.

- Understanding the total cost of ownership helps avoid budget overruns and ensures wise spending decisions.

The Hidden Costs of Cheap Products

When you opt for cheap products, you might think you're saving money, but hidden costs can quickly add up.

Low-priced textiles, like towels and bath mats, often wear out faster, leading to repeated expenses as you replace them frequently. This cycle of buying low-quality items can create financial stress, forcing you to constantly cut back on your household budget. In fact, investing in durable products can also promote a more sustainable lifestyle, similar to the benefits seen in the tiny house movement. Additionally, investing in quality items encourages mindful decluttering and prevents clutter from accumulating due to frequent replacements. For example, opting for eco-friendly practices in your purchases can enhance both durability and safety. Choosing materials like natural fibers can also improve the aesthetic and comfort of your space.

While initial savings seem attractive, the long run reveals that investing in higher-quality alternatives pays off. These products can last over five years, ultimately saving you money and reducing waste. Additionally, regular maintenance can extend appliance lifespan and help you avoid costly repairs associated with cheap appliances.

Long-Term Impacts on Quality

Choosing low-quality products not only affects your immediate expenses but also has lasting repercussions on quality. Financial experts warn that the long-term impacts of purchasing inferior consumer goods can lead to higher monthly expenses.

For instance, you might find yourself repeatedly replacing items that wear out quickly, which ultimately costs more than investing in durable alternatives. Higher-quality textiles can last over five years, proving more cost-effective in the long run. Additionally, consistent maintenance of air purifiers ensures their optimal performance and can prevent costly repairs or replacements. Investing in robot vacuums can also provide a more efficient cleaning solution that lasts longer than cheaper alternatives. Moreover, opting for appliances with EnergyGuide labels can help you make informed choices that lead to better energy savings over time. Furthermore, selecting air purifiers with HEPA filters can significantly improve indoor air quality and reduce the need for frequent replacements.

Additionally, low-cost insurance often offers inadequate coverage, leading to out-of-pocket expenses when you need it most. If your spending plan prioritizes short-term savings over quality, you may soon realize that cutting corners on products can strain your income covers, leaving you worse off financially. Moreover, investing in higher-quality textiles can significantly reduce the frequency of replacements, ultimately saving you money over time.

Risks of Inadequate Services

Opting for inadequate services can lead to significant financial pitfalls that often go unnoticed until it's too late. You might think you're saving money, but hidden costs can quickly add up.

For instance, poor quality services can result in inadequate coverage, leaving you exposed to expenses like data breaches that average $4.24 million. Additionally, low-cost solutions often lead to operational inefficiencies, costing businesses up to $300 billion annually.

If you have high turnover rates, replacing employees can cost 1.5 to 2 times their annual salary. Finally, neglecting customer satisfaction can drive away up to 30% of your customers, ultimately costing you money that far exceeds any initial savings.

Investing wisely in quality services is key to protecting your financial skills.

Consequences of Cutting Corners

When you cut corners to save money, you might find those short-term savings quickly turn into long-term expenses.

Choosing cheaper products or services often leads to more frequent replacements and hidden costs that add up over time.

Ultimately, what seems like a smart financial move can backfire, costing you more in the end.

Short-Term Savings Risks

Cutting corners to save money might seem like a smart strategy, but it often leads to unexpected consequences that can outweigh any initial savings.

While you might enjoy short-term savings, inadequate coverage from skimping on insurance or maintenance can result in costly repairs down the line. Choosing cheaper goods often means frequent replacements, making higher-quality items more cost-effective in the long run.

Additionally, extreme cost-cutting in heating can lead to serious health issues and increased healthcare expenses. In business, neglecting proper inventory management can cause overstocking or stock-outs, driving up expenses.

Finally, failing to invest in technology can create operational inefficiencies, costing businesses billions annually. Your financial skills may not save you here.

Long-Term Expense Growth

Neglecting essential services to save a few bucks often leads to a snowball effect of rising expenses down the road. Cutting corners might seem smart initially, but those savings can vanish quickly due to hidden costs. Furthermore, neglecting essential services can lead to decreased efficiency and productivity, resulting in greater time and resource expenditure in the long run. Investing in a timesaving productivity solution may require an initial upfront cost, but it can ultimately save time, streamline processes, and reduce overall expenses. By prioritizing essential services and implementing efficient solutions, businesses can avoid the pitfalls of cutting corners and truly optimize their operations.

| Service Type | Long-Term Expense Impact |

|---|---|

| Low-Cost Insurance | 30% more in claims |

| Cheap Consumer Goods | Up to 50% more in replacements |

| Neglected Maintenance | $10 in future repairs per $1 saved |

| Lowest-Cost Cybersecurity | Average breach cost of $4.24 million |

Investing in quality and focusing on preventative maintenance enhances your financial skills. In the end, long-term expenses outweigh the initial savings, so it's wise to prioritize quality over the lowest-cost option.

The Balance Between Cost and Value

When you're considering budget options, it's essential to weigh quality against quantity.

Choosing cheaper products might save you money upfront, but hidden long-term costs can quickly add up.

Smart spending choices focus on value, ensuring that your investments truly pay off over time.

Quality Over Quantity

In today's fast-paced world, making smart purchasing decisions can greatly impact your finances and overall satisfaction.

Prioritizing quality over quantity can save you money in the long run. For instance, investing in higher-quality clothing or home goods often means they'll last five years or more, unlike cheaper alternatives that require frequent replacements.

While the initial costs for quality items might seem high, they're more cost-effective because they prevent future expenses and hassle. This also applies to financial services—low-cost insurance policies may leave you with inadequate coverage, leading to increased out-of-pocket expenses.

Hidden Long-Term Costs

Considering the allure of low prices, it's easy to overlook the hidden long-term costs associated with cheap consumer goods and services. For instance, higher-quality items often last over five years, while frequent replacements from budget cuts can rack up expenses. Additionally, extreme cost-cutting measures, like reducing heating, may lead to increased healthcare costs. Low-cost financial services frequently provide inadequate coverage, resulting in higher out-of-pocket expenses later.

| Budget Options | Long-Term Impact |

|---|---|

| Cheap Tools | Inadequate tools hinder productivity |

| Low-Quality Items | Frequent replacements increase costs |

| Reduced Tech Investment | Operational inefficiencies arise |

| Minimal Insurance | Higher out-of-pocket expenses |

| Underfunded Healthcare | Increased healthcare costs |

These factors prove that saving upfront can cost you more down the line.

Smart Spending Choices

Smart spending choices can greatly impact your financial health. By honing your financial skills, you can balance costs and value effectively.

While saving money on cheaper goods might seem appealing, these often lead to frequent replacements, increasing your long-term expenses. Instead, invest in higher-quality items that meet your basic needs and last longer.

Similarly, low-cost insurance might save you upfront, but inadequate coverage could hit you hard later. Embracing lifestyle changes that prioritize quality over quantity can prevent future financial stress.

This better understanding of spending allows you to make informed decisions that reduce unnecessary expenses. Ultimately, smart spending choices lead to sustainable financial practices, enhancing your overall satisfaction and securing your financial future.

The Importance of Sustainable Choices

Making sustainable choices isn't just about being environmentally conscious; it's also a savvy financial strategy. When you invest in quality products, you often see significant savings over time. Cheaper, lower-quality items may seem appealing initially, but they usually lead to higher long-term costs as they wear out faster.

Additionally, extreme cost-cutting in areas like heating can result in increased healthcare expenses due to health issues, negating any initial savings. By prioritizing quality services, such as extensive insurance, you prevent future financial burdens from inadequate coverage.

Sustainable financial practices reduce stress and enhance overall satisfaction. Ultimately, investing wisely in quality not only lowers your expenses but also fosters a healthier, more stable financial future.

Investing in Quality for Efficiency

Investing in quality products and services directly boosts your efficiency and effectiveness. By choosing higher-quality options, you'll save money in the long run since they typically last longer and require fewer replacements or repairs.

For instance, quality textiles can last over five years, reducing operational costs. Studies show that companies prioritizing quality software and services see a 20% higher return on investment, highlighting the financial advantages of this approach.

Additionally, utilizing quality inventory management software optimizes stock levels, cutting costs related to overstocking or stock-outs. Investing in robust cybersecurity measures also prevents costly data breaches, which can average $4.24 million.

Ultimately, prioritizing quality fosters efficiency and contributes greatly to your overall financial savings.

Understanding Total Cost of Ownership

Understanding the Total Cost of Ownership (TCO) is essential for effective budgeting and long-term financial planning. TCO encompasses not just the initial price but also long-term costs like maintenance and hidden costs that can arise unexpectedly. By recognizing these factors, you can avoid budget overruns and operational inefficiencies.

| Cost Category | Description | Impact on TCO |

|---|---|---|

| Purchase Price | Initial investment | Direct cost |

| Maintenance Costs | Repairs and regular upkeep | Long-term costs |

| Hidden Costs | Lost productivity and inefficiencies | Escalates expenses |

| Return on Investment | Long-term benefits from quality assets | Increases overall ROI |

Investing wisely can boost your ROI while minimizing long-term expenses.

Frequently Asked Questions

Why Are Costs Variable in the Long Run?

Costs are variable in the long run due to several factors.

You'll notice that inflation can steadily increase prices for goods and services, affecting your budget.

Additionally, maintenance and repair expenses can add up if you opt for cheaper items that break down sooner.

Changes in usage patterns can also lead to fluctuating variable costs, like energy consumption, which might surprise you with unexpected increases over time.

Why Does a Firm's Costs Differ in the Short-Run and in the Long Run?

Think of a balloon being filled with air. In the short-run, a firm's costs can fluctuate wildly, like that balloon expanding unevenly.

Fixed costs remain constant, while variable costs ebb and flow with production.

However, in the long run, as the firm grows, it spreads those fixed costs over more units, leading to lower average costs.

This allows you to fine-tune operations, becoming more efficient and reducing costs over time.

Which Types of Costs Do You Have in the Long Run?

In the long run, you'll encounter both fixed and variable costs.

Fixed costs, like rent or salaries, remain constant regardless of your production level, while variable costs fluctuate with your output, such as materials or utilities.

You'll also face opportunity costs, which represent the benefits you miss out on from choosing one option over another.

Understanding these costs helps you make better financial decisions and plan for sustainable growth in your endeavors.

Why Are Short-Run Costs Higher Than Long Run Costs?

When you're in a pickle, short-run costs can skyrocket. You might need quick fixes that come with premium pricing, or outdated tech could slow you down, leading to inefficiencies.

Plus, if you opt for cheaper materials, you'll likely face frequent breakdowns and higher maintenance costs. Without investing in your workforce or planning properly, you're also looking at increased overtime and logistics expenses.

In short, immediate needs can really add up!

Conclusion

In the end, opting for budget options might seem like a smart move, but it can cost you more down the line. Did you know that nearly 50% of consumers end up spending more on repairs and replacements for cheap products? By investing in quality, you not only get better performance but also save money over time. Remember, it's not just about the initial price; it's about the total cost of ownership and the value you truly receive.